Finally, a Proven Strategy To Dramatically Increase Net Income and Eliminate Employee Benefit Costs From Your Bottom Line.

- 0

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- -

- 0

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- -

- 0

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- -

- 0

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- -

- 0

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- -

- 0

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- -

- 0

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- -

- 0

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- -

- 0

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- -

As of January 2026, Credit Union Benefit manages over $400M in credit union investment assets.

Understanding NCUA reg. 701.19

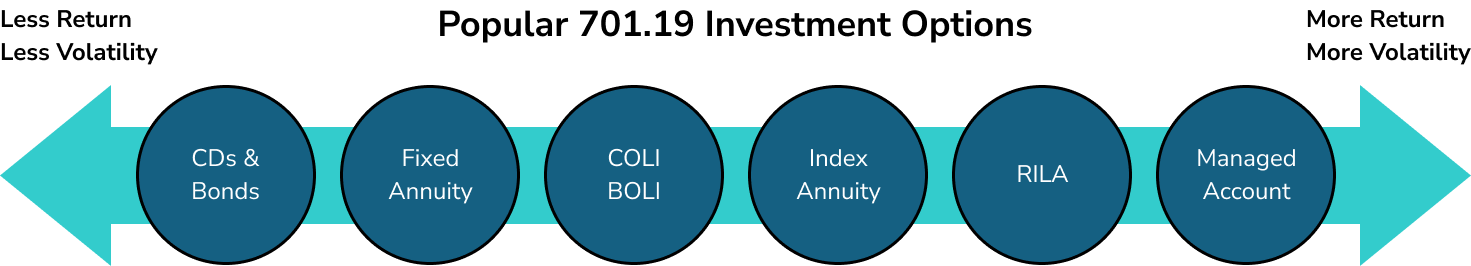

Historically, credit unions have been limited to low-yield investment options such as stocks, bonds, COLI, and split-dollar arrangements. These traditional investments, while stable, have constrained their ability to generate meaningful returns.

NCUA reg. 701.19 expands investment capabilities, allowing credit unions to access higher-yield opportunities—provided the additional income is used to benefit employees. This regulatory advantage is what enables Credit Union Benefit to generate superior returns for our clients while ensuring sustainable financial growth.

Total Benefit Prefunding (TBP) Solution: Leveraging 701.19 for Maximum Returns

Rising employee benefits costs are putting financial pressure on credit unions of all sizes. Our Total Benefit Prefunding Solution helps credit unions leverage the expanded investment options provided by NCUA reg. 701.19 to offset these costs.

For credit unions that may not have the liquidity to fully fund employee benefits, we identify other investment sources for prefunding opportunities – for example, liquidating underperforming CDs and bonds.

"I appreciate Credit Union Benefit’s ability to think outside the box and craft an investment plan that benefits not only our employees, but the credit union as a whole. We have been using CU Benefit since 2020 and with their assistance have passed multiple NCUA audit exams."

Steven Adee

President/CEO

CUB's Solutions for Credit Unions Like You

Utilize investment proceeds to fully-fund your employee benefits in compliance with NCUA reg. 701.19

Learn More

Earn 2-3X higher returns than life insurance-based COLI or Split Dollar plans for key executive retirement.

Learn More

Liquidate underperforming investments and allow our carriers to cover losses with a deposit bonus. Liberate funds for higher yielding investments.

Learn MoreCredit Union Benefit's Exclusive Insights for...

If your board has invested in a life insurance-based COLI, you may be missing out on 2-3X the potential returns.

By reallocating funds into NCUA-compliant investments, you can maximize executive benefits while avoiding the 25% net worth cap restrictions associated with life insurance policies.

Enter your credit union Charter Number and see your Total Benefit Prefunding Solution estimate based on your NCUA-reported financials.

...

Net Income

Current

Anticipated

Increase Percentage

Note: The information provided above is only an estimate. Actual figures may vary. "Current" NI number updated quarterly.

Find Out Your Investment Growth Potential

Type in your credit union’s charter number, and we will provide an estimate on what you can expect from the program. The projection is based upon NCUA-reported financials and our calculation, based on past performance.