Videos

Explore CUB's Three Pillars representing Total Benefit Prefunding, Converting Underperforming Assets and Accelerated Executive Benefits. (1:50)

Case Studies

GOAL: Create a more robust Executive Retention package

Asset size: $137 million

Challenges:

- Wanted to reward and retain executive team, but didn't have the budget.

- Implemented a 401K, but had no match and poor participation.

- Experienced trouble finding staff due to its rural location.

Plan: Invest $1.25 million a quarter for five years

Result: When the market was down over 25% in 2020, the credit union experienced zero losses and earned over 17% in the subsequent recovery. The credit union recouped all employee benefit costs by year four and implemented an executive retention package.

GOAL: Stop passing on cost increases to employees and fund benefits 100%

Asset size: $347 million

Challenges:

- Wanted to build a retention package for their new CEO.

- Costly renewal rates on their health insurance premium had shifted more of the financial burden to employees.

Plan: Invest $5 million a year for seven years

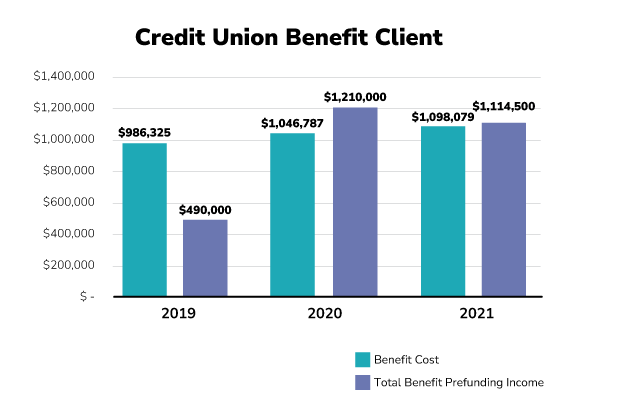

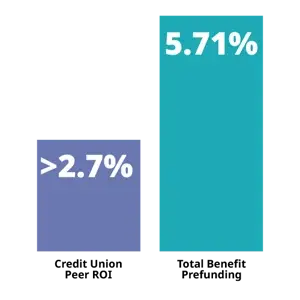

Result: Four years into the program, the credit union is on track to pay 100% of health premiums for employees by year seven. They reported no market losses during the COVID period as well as in 2022, which ensured an ability to build for the future. Average ROI for the credit union’s peer group is under 2.7%; in comparison, ROI on the Total Benefit Prefunding Solution has been 5.71%.

Brochures / FAQ

White Papers

Enhancing Financial Stability and Covering Employee Benefit Costs

The financial landscape for credit unions is constantly evolving with increasing competition, regulatory pressures, and the on-going challenge of managing employee benefits costs.

Credit Union Benefit’s Total Benefit Prefunding Solution offers an innovative way for credit unions to address these challenges by turning employee benefits from a financial burden into a strategic asset.

This white paper aims to provide a comprehensive understanding of how our Total Benefit Prefunding Solution can help credit unions improve their financial stability, offer more sustainable employee benefits, and achieve long-term growth.

COLI vs. TBP (Total Benefit Prefunding) for Executives

Based upon dismal life insurance performance and relying on a death benefit to make the credit union whole, COLI is no longer the best product in town for credit union executives and their boards.

Total Benefit Prefunding allows credit union board of directors the ability to invest in higher yielding investments (3X the rate of life insurance) for the benefit of their executive's retirement.

In addition, unlike life insurance-based investments like COLI, the credit union doesn't need to wait for a death benefit to be made whole AND there is no 25% net income cap. That translates into being able to cover more executives than just the CEO - why not retain ALL of your key executives, right?

Industry News

CU Influential: Benefits Prefunding - The Holy Grail for Credit Unions (featuring Credit Union Benefit)

The financial landscape for credit unions is constantly evolving with increasing competition, regulatory pressures, and the on-going challenge of managing employee benefits costs.

Credit Union Benefit’s Total Benefit Prefunding Solution offers an innovative way for credit unions to address these challenges by turning employee benefits from a financial burden into a strategic asset.

This white paper aims to provide a comprehensive understanding of how our Total Benefit Prefunding Solution can help credit unions improve their financial stability, offer more sustainable employee benefits, and achieve long-term growth.

Published by:

Executive Retirement Comparison Chart

| Program | Product | Fees | Yield after Fees | Liquidity | Maximum Investment | Who Benefits? |

|---|---|---|---|---|---|---|

| Executive Benefit Life Insurance Options | COLI | 1.5%-3% | 2.5%-3.5% | After surrender charges expire usually 10-20 years | 25% of Credit Union's net worth | Can benefit all employees, but limited to the 25% of net worth rule |

| Split-Dollar | 1.5%-3% | 3-4% for CU 1.5-2% for executive |

Credit Union-Usually no liquidity available until death of executive. Executive-Able to borrow money in retirement if the policy performs. |

25% of Credit Union's net worth | A few key executives | |

| Total Benefit Prefunding by Credit Union Benefit | Multiple Options | 0%* | 6-8%** | Up to 10% per year or after surrender charges expire 5-10 years | No maximum investment amount, rather the credit union just can't consistently earn more than the cost of their employee benefits | All employees and executives as it can cover 100% of employee benefit expenses |

* Unless Credit Union wants to add an additional rider for their benefit

** Based on worst 10yr performance

Download our white paper on this topic