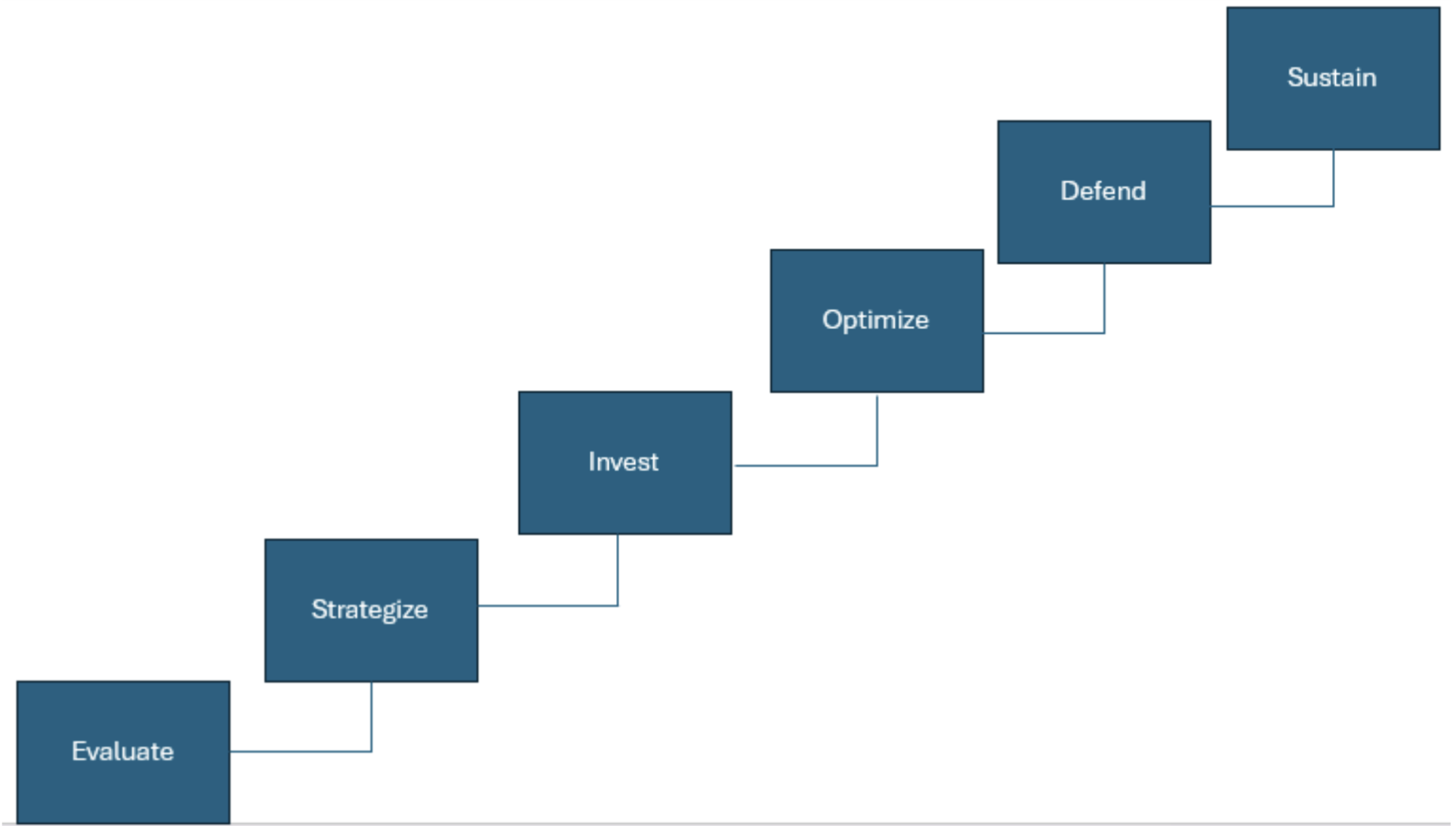

Six Steps to Financial Transformation

Credit Union Benefit provides support every step of the way during the investment transformation. From the initial evaluation of your current investment state to recommending NCUA-compliant investments to providing on-going support to ensure compliance and long-term growth, Credit Union Benefit is a partner for the duration.

- Evaluate - Assess current investments, benefit costs, and financial goals.

- Strategize - Craft a tailored investment plan based on your credit union’s needs.

- Invest - Transition funds into higher-yield vehicles with zero risk to principal.

- Optimize - Monitor performance and adjust for optimal returns.

- Defend - Prepare for and present data based upon NCUA audit requests.

- Sustain - Ensure long-term growth and stability with ongoing performance strategy updates.

We Work With your Existing Benefits Provider

Credit Union Benefit is NOT a benefits provider. Our goal is to create a solid investment program that will enable you to cover your employee benefit costs (and their annual increases) with investment yields. We do, however, work directly with your benefits provider to determine additional options and strategies based upon your program’s investment yield performance.

For example, over time, many clients find their investment yields exceed what is necessary to cover traditional benefit costs such as healthcare, vision, and dental. In those scenarios, they may want to apply the surplus to fund additional benefits that will resonate with employees.

Here are some examples of what can be covered with excess investment yields:

- Annual board meeting trips

- Board member education

- Employee continuing education

- 401K plan administration costs

- 401K plan matching increases

- Employee spot bonuses

- Employee conferences, seminars, and training, including fees and travel expenses

- Employee holiday and vacation pay

- Employee team incentives

- Employee long-term care, sick days/PTO, pensions

Excess funds can be used to cover anything that benefits employees apart from salaries and commissions.

How Credit Union Benefit is Compensated

There is no cost for CUB consulting, designing, or implementation of your plan. Depending on the strategy chosen, CUB is compensated in one of two ways:

- Insurance company or investment provider pays CUB a commission at no cost to the credit union. (90% of cases)

- CUB charges a percentage of the plan for fee-based solutions. (10% of cases)

CUB is unbiased in its investment recommendations—it serves as a credit union's advocate to find the most competitive and innovative way to achieve your employee benefit pre-funding goals.