Turn Rising Employee Benefit Costs Into a Strategic Advantage

Employee benefit costs are one of the largest recurring expenses for credit unions—consistently eroding capital and net worth. With healthcare costs rising at an average of 6% annually over the past decade, this financial pressure is only expected to intensify.

While full-time employees are entitled to healthcare benefits, credit unions have options when it comes to managing these escalating costs:

- Shift part or all of the cost increase to employees

- Reduce or limit benefit offerings

- Negotiate with providers

- Absorb the costs directly

But there’s a fifth option—one that turns a liability into an asset.

Regulation 701.19: A Game-Changer

The NCUA’s Rule 701.19 empowers credit unions to invest in previously non-permissible assets—as long as the returns are used to offset employee benefit costs.

Since 2019, Credit Union Benefit has helped credit unions nationwide deploy its Total Benefit Prefunding strategy, managing over $400 million of credit union assets in investment capital. Our approach is tailored to each credit union’s goals, risk tolerance, and investment ability, using solutions from the highest rated providers.

How It Works

We collaborate with executive teams to:

- Assess current and projected benefit costs

- Design investment strategies to match funding goals

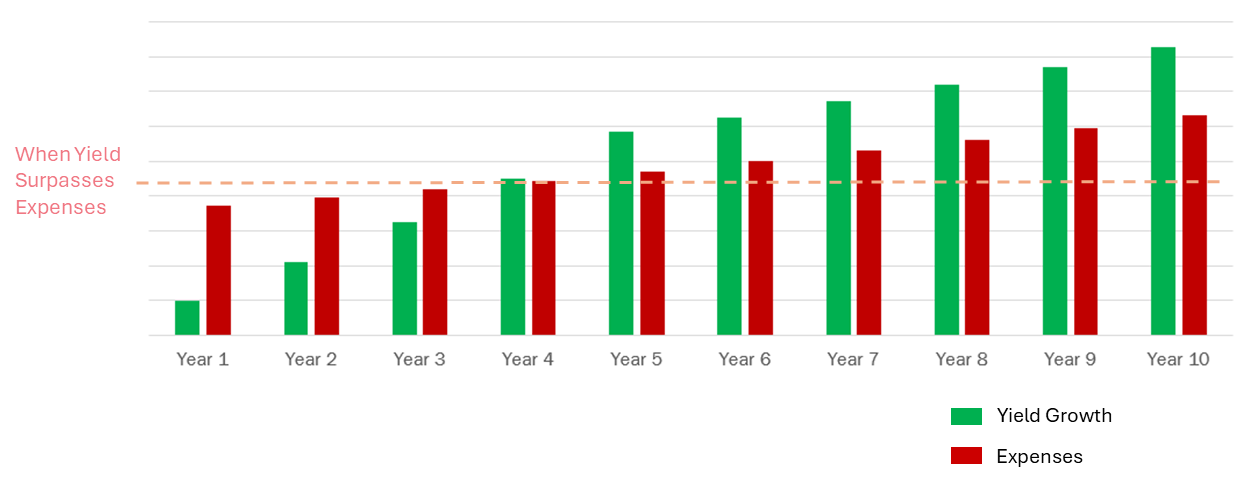

- Model timelines for when investment yields will offset costs

- Adjust strategies as your credit union evolves

In the scenario below, a credit union invests annually for five years. By year five, investment yields cover benefit costs entirely. From year six onward, excess yields can be used to:

- Reimburse the original investment

- Fund increased benefit offerings like 100% of health insurance premiums, increased 401(k) match, better executive benefits and much more...

All within the boundaries of NCUA regulations.

Case Study: Transforming Benefit Costs into a Self-Sustaining Asset

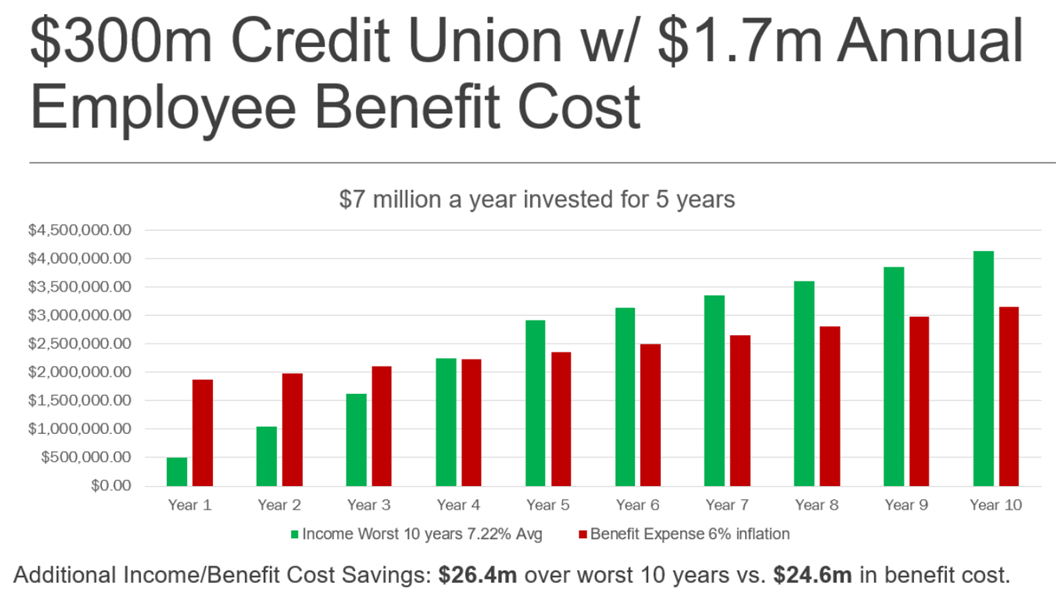

Our client is investing $7 million annually for five years into a product with zero principal risk and zero volatility. The illustration assumes the worst historical performance of their chosen investment solution as a conservative benchmark:

-

By Year 5:

The investment yields are projected to fully cover all employee benefit costs, including a 6% annual increase—with zero reliance on additional funding.

-

Year 6 Onward:

The accumulated investments continue generating sufficient returns to permanently fund employee benefits, requiring no further contributions.

Result: The credit union becomes completely free of employee benefit costs—forever.

The Total Benefit Prefunding strategy transforms a recurring liability into a perpetual financial asset for the credit union, unlocking long-term budget flexibility and strategic freedom.